These days, anyone can easily buy and use dollar-pegged stablecoins like USDT and USDC, so is there really a need for a KRW-based stablecoin? I’ve been thinking about this question.

Looking at the current Korean digital asset market, KRW stablecoins, STOs, local currencies, and Bitcoin ETFs seem to be the main issues. However, the second phase of the Virtual Asset Act feels somewhat lacking compared to expectations. Overseas, digital investment products like dollar-based stablecoins and crypto ETFs have already seen tremendous growth. As a result, there’s a sudden surge of stablecoin experts in Korea, and companies, institutions, and even the government are treating this issue as important.

Stablecoins are useful for daily life because they are not volatile, making them ideal for remittances and payments, and they serve as a bridge between fiat and crypto markets. They are also the underlying assets for DeFi products and can pay interest, making them quite useful from a user’s perspective.

On the other hand, there are concerns that creating a KRW-based stablecoin could allow foreign entities to control the won. That’s why some argue that a CBDC (Central Bank Digital Currency) alone is sufficient. There’s also much debate over who should issue a KRW stablecoin—should it be traditional financial institutions, or should companies also have the opportunity? Everyone has a different stance.

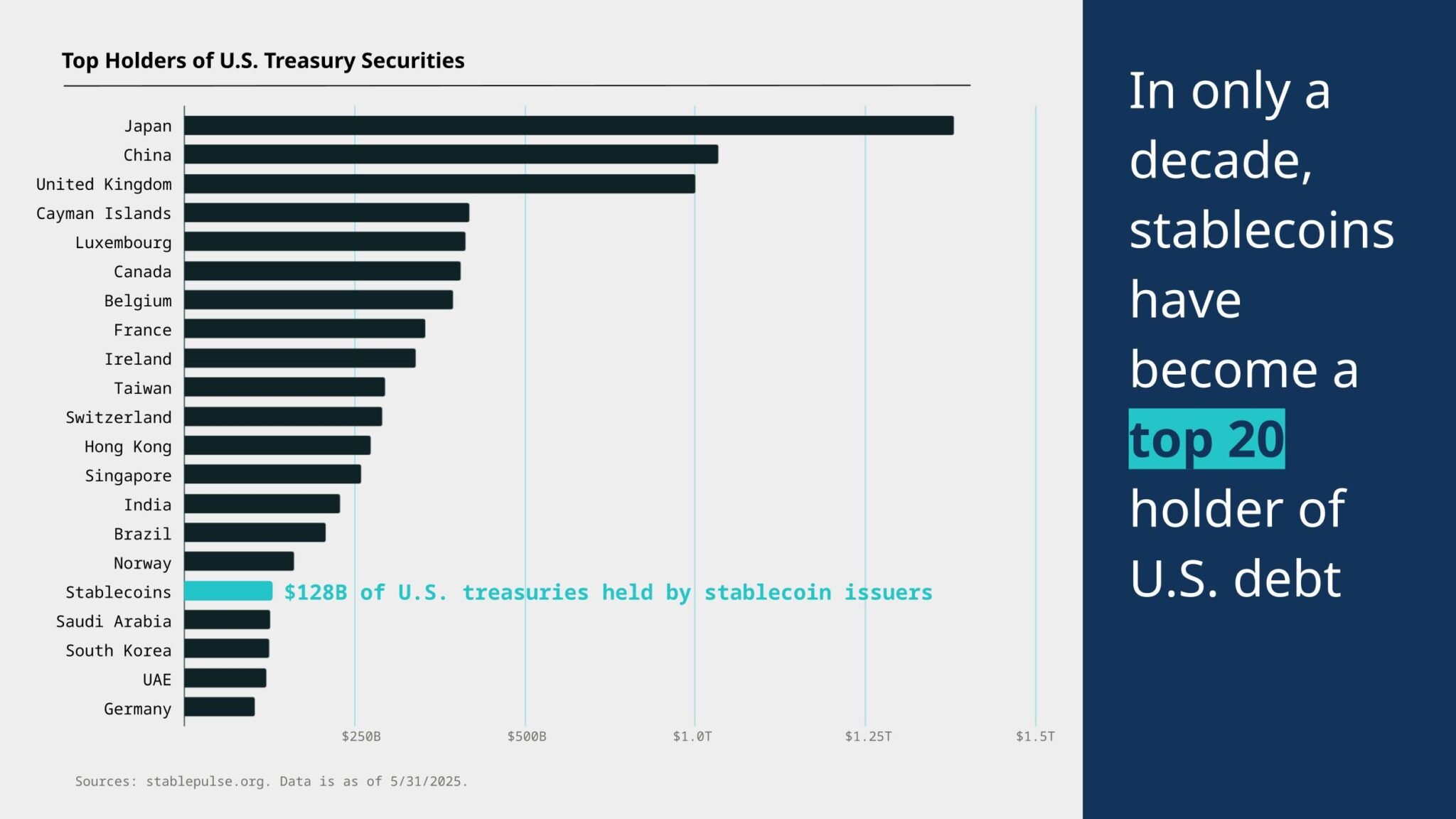

In fact, the U.S. government is promoting dollar-based stablecoins to increase demand for U.S. Treasury bonds, and from a user’s perspective, stablecoins are hard to avoid because they offer price stability and low remittance fees. In reality, overseas workers are already receiving salaries in stablecoins and sending money home cheaply.

Ultimately, dollar-based stablecoins are already so convenient and powerful—will people really use a KRW-based stablecoin? Honestly, I’m skeptical. If a KRW stablecoin is to be created, it would need to guarantee stable returns for users, be usable for various purposes like local currencies, vouchers, or points, and offer government-backed benefits to be even somewhat viable.

Technically, creating a stablecoin isn’t difficult. However, legal and policy frameworks, as well as integration with CBDCs, are much more important. For a KRW stablecoin to have real meaning, it should be treated as a public good and be open for various companies to utilize freely12.

'블록체인' 카테고리의 다른 글

| 🇰🇷 한국 VASP 제도의 민낯: 왜 바뀌어야 하고, 어디로 가야 하는가? (0) | 2025.06.20 |

|---|---|

| 혁신인가, 새로운 리스크인가? Ethena의 합성 달러 'USDe' 집중 분석 (0) | 2025.06.18 |

| Comparative Analysis of South Korea's Digital Asset Basic Act and Major Countries' Digital Asset Laws (2) | 2025.06.11 |

| 한국 디지털자산기본법과 주요국 디지털자산 법률 비교·분석 (0) | 2025.06.11 |

| 이해하기 쉬운 "디지털자산기본법안" 정리 및 보강할 점들 (3) | 2025.06.11 |

| 달러 스테이블코인 시대, 원화 스테이블코인은 필요할까? (4) | 2025.06.08 |

| K-Stable 코인의 미래와 성공 전략 (4) | 2025.05.22 |

| 대기업 두나무의 자회사 람다256에게 공개 질의를 합니다. (4) | 2025.05.17 |

| 🇰🇷 KRW Stablecoins: Are They Really Necessary? The Key Lies in 'Yield' and 'Regulation'! 💸 (0) | 2025.05.15 |

| 🇰🇷 원화 스테이블 코인, 정말 필요할까요? 핵심은 '수익'과 '제도'입니다! 💸 (1) | 2025.05.15 |